Grain provides a convenient credit solution for your existing checking account, without the need to inquire about your credit score. Unlike many other lending platforms, Grain swiftly approves your primary checking account, granting you quick access to credit within minutes. This credit can be effortlessly transferred to your linked account, functioning as instant cash.

However, it’s important to note that the Grain app is currently limited to Apple devices, which unfortunately excludes a substantial number of potential customers. Furthermore, the app has faced criticism due to its subpar customer support.

Thankfully, the market offers several excellent alternatives that cater to both secure and insecure credit lines. These alternatives present a variety of financing options, including traditional loans as well as innovative approaches such as crowdfunding.

To assist you further, we have curated a list of exceptional apps similar to Grain, which enable direct cash transfers to your checking account. Some of these apps even assist in building your credit score and managing expenses effectively.

Table of Contents

Credit Sesame

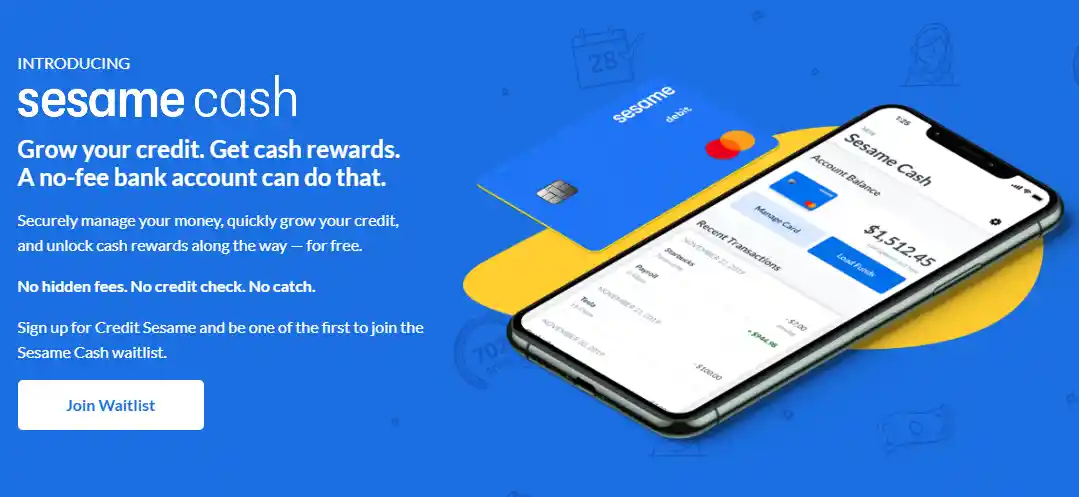

Credit Sesame has empowered countless users in improving their credit through its innovative services. With its mobile banking app, you gain the ability to track your credit, accumulate savings, and receive tailored financial advice.

Through Credit Sesame, you gain access to an account known as Sesame Cash, specifically curated to promote your overall financial well-being. By transferring funds to this account, you unlock a Sesame debit card that offers enticing cashback opportunities.

This versatile debit card can be utilized at any establishment that accepts Mastercard, and it seamlessly integrates with popular payment platforms such as Google Pay, Apple Pay, and Samsung Pay.

Bright – Conquer Your Credit Card Debt

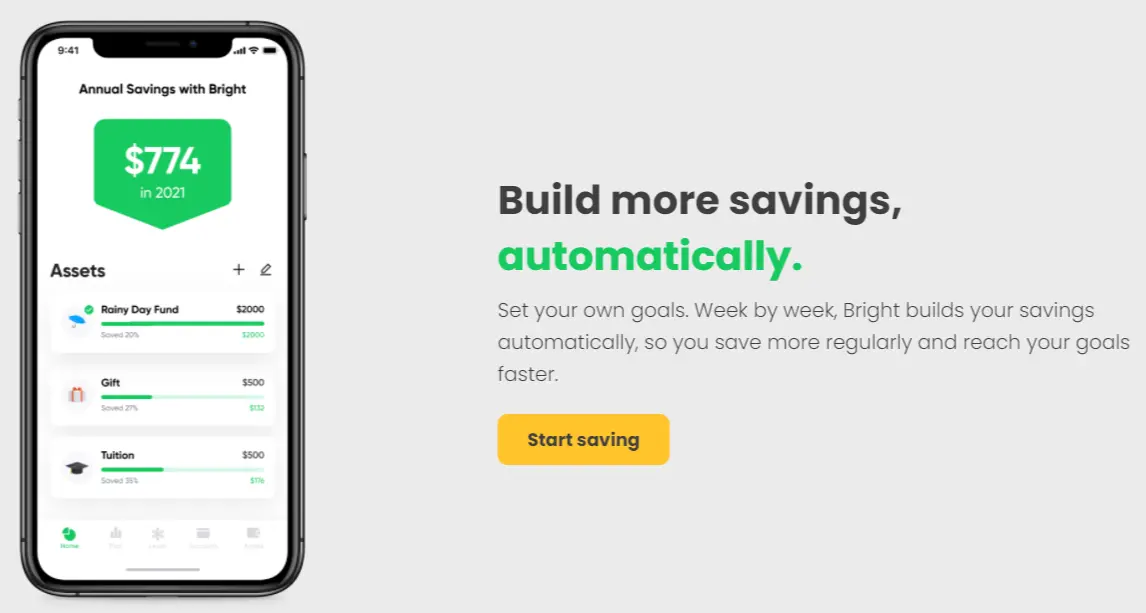

Bright is a comprehensive app designed to assist you in conquering your credit card debt, establishing a credit score, and effectively managing your finances. Once your account is approved, you can begin by accessing a low-interest line of credit. With a favorable Annual Percentage Rate (APR), Bright can lend you up to $8,000.

The app incorporates a Smart Manager feature that automates your monthly repayments. By prioritizing the repayment of high-interest loans, Bright accelerates your journey towards a debt-free future. Additionally, if you consistently make payments before the due date, Bright rewards you by increasing your credit limit, ultimately leading to a positive impact on your credit score.

Line – Instant Cash with Deferred Payment

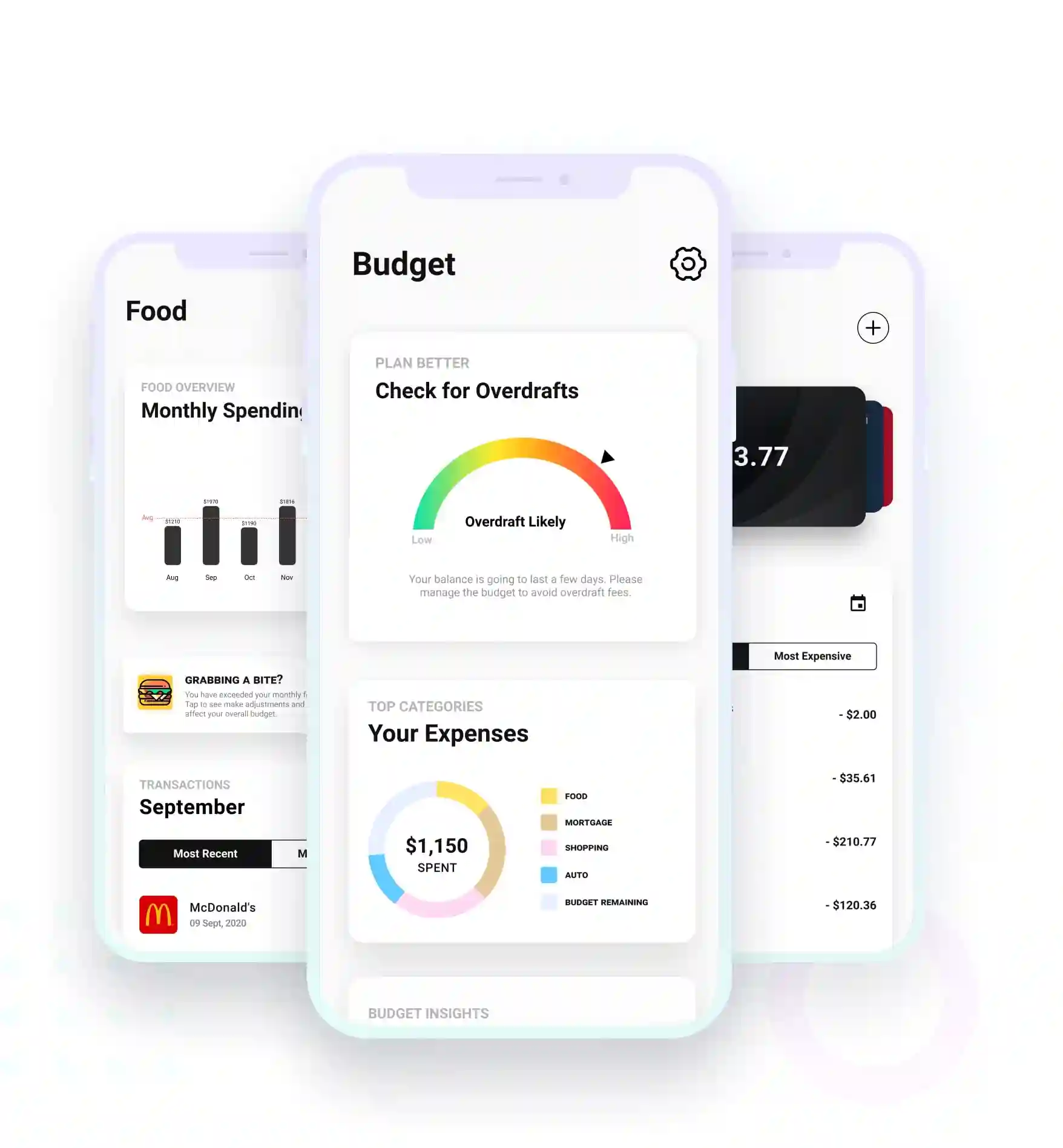

Line offers the convenience of obtaining an instant cash advance of up to $250. You have the flexibility to choose how the money is transferred – whether it’s to your bank account, debit card, or even a gift card.

What sets Line apart is that the funds borrowed are not classified as a traditional loan, meaning they won’t impact your FICO score. Instead, Line charges a flat fee for transferring the cash to your bank account or debit card. This flat fee is significantly lower than the interest you would typically incur.

It’s important to note that this emergency cash line is available to members who subscribe to a modest fee, approximately $1.97 per month. By maintaining an active paid subscription and adhering to Line’s community guidelines, including timely debt repayment, you become eligible for higher amounts, potentially up to $1,000.

Chime

Chime is an innovative financial technology company that provides a range of banking products, including zero-balance checking accounts, early wage access, and an automated savings system.

By collaborating with regional banks, Chime aims to foster a competitive market that offers improved and cost-effective solutions for individuals who have been underserved by traditional banking institutions. Their user-friendly banking app is thoughtfully designed to offer seamless support.

The Chime app is completely free to use and prioritizes the security of your funds. It even offers the convenience of overdraft protection up to $200 without any associated fees. Additionally, you can easily set up direct deposit and enjoy the perk of receiving your paycheck up to two days earlier than your colleagues.

SoLo Funds: Borrow and Lend with Ease

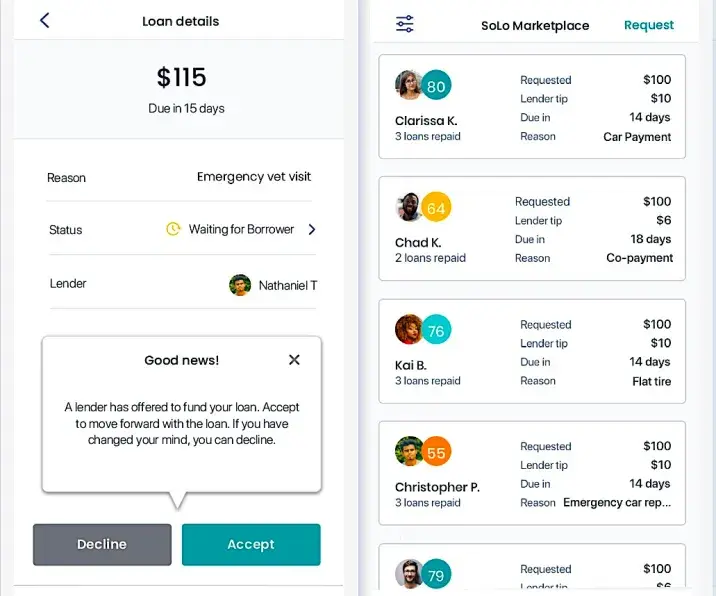

SoLo Funds provides a user-friendly platform that enables everyone to borrow money at a low cost or participate as lenders and earn a return. The app fosters a collaborative community that aims to create mutually beneficial outcomes and promote financial independence for all its members.

One of the notable advantages of SoLo Funds is the ability to borrow money on your own terms. You have the freedom to select the loan amount, payback date, and even determine the appreciation tip for lenders. By consistently repaying your loans punctually, you can increase your SoLo Score, enhancing your eligibility for borrowing higher amounts in the future.

Alternatively, if you have funds available in your account, SoLo Funds provides an opportunity to lend money to individuals in need and earn additional income. As the lending amounts are smaller and the durations shorter, you can expect to receive your capital back at a faster rate compared to other platforms.

Extra

Extra is an innovative debit card that offers the dual benefits of building credit and earning reward points. Its user-friendly approach makes it incredibly simple to use. All you need to do is link your bank account, and Extra will determine your spending limit based on your transaction history, without the need to check your credit score.

Once you have been assigned a spending limit, you can use the Extra card just like any regular debit card, making purchases at any desired location. At the end of each month, Extra compiles all your purchases and reports them to the credit bureaus, contributing to the establishment and enhancement of your credit profile.

Consistently using the card will result in an increase in your spending limit. The more transactions you make, the higher your spending limit will become. Alternatively, you can also complete daily tasks within the app to further boost your spending limit.

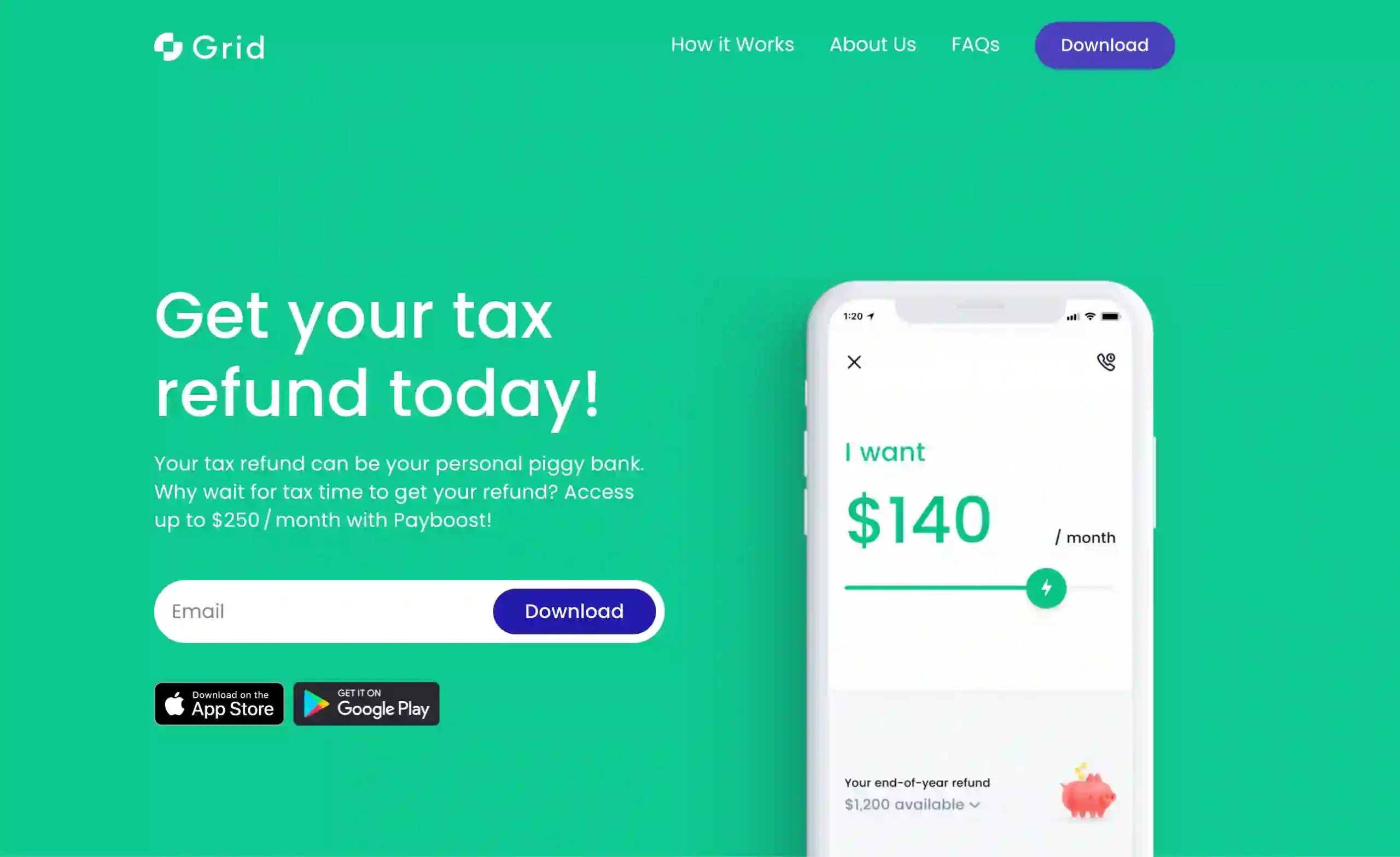

Grid Money – Cash, Credit Building, Wise Spending, and Efficient Tax Filing

Grid Money offers a seamless experience where you can access cash, establish credit, make wise financial decisions, and efficiently handle your taxes. The app’s user-friendly interface makes it effortless to navigate and enjoy its array of features.

With Grid, you have the convenience of obtaining on-demand cash advances, with each advance allowing you to access up to $200 without undergoing a credit check. Alternatively, by purchasing a Grid+ membership, you gain unlimited access to cash advances.

A notable feature called BoostCard incentivizes credit building. By utilizing this feature, you can earn up to $100 in cash rewards each month as you work towards improving your credit.

Unlike many other apps, Grid Money goes the extra mile by assisting you in receiving your tax refund ahead of schedule. By providing your financial and household details and linking your jobs to the app, Grid Money will analyze the numbers and present you with the option to increase the amount on your paycheck. This flexibility allows you to tailor the additional amount based on your specific financial circumstances, with the ability to adjust it on a monthly basis.

CashNetUSA

When faced with financial emergencies, it’s crucial to rely on a reputable lender. CashNetUSA, a subsidiary of Enova International, one of the leading financial technology companies, has a proven track record of assisting over 4,000,000 users in overcoming financial challenges over the past 16 years.

To enhance accessibility, CashNetUSA has developed an app that simplifies credit management, catering to individuals with less-than-perfect credit scores.

The process begins with filling out an application. Upon approval, your available credit will be displayed on the dashboard. You can conveniently withdraw the funds to your account on the same day. Draw requests submitted after 1 p.m. are processed on the next business day.

ZayZoon

ZayZoon collaborates with various payroll partners to provide you with on-demand access to your wages. With its extensive network of partnerships with major payroll platforms, ZayZoon empowers employees by granting them control over their paychecks.

Through ZayZoon, you have the flexibility to choose how much of your wages you would like to receive in advance. Upon request, ZayZoon promptly disburses the funds to you, allowing you to address unexpected expenses. The amount you accessed is automatically deducted from your next salary during the subsequent pay run, ensuring a seamless recovery process.

The app as a whole is designed to alleviate financial stress, helping you pay unforeseen bills without resorting to unnecessary debt. Additionally, ZayZoon offers a range of financial wellness tools, including accurate financial tracking, overdraft estimation, and valuable financial education resources.

Conclusion

As per the Federal Trade Commission, fraudulent practices result in consumers losing over $3 billion annually.

The market is saturated with numerous fake companies that aim to deceive unsuspecting individuals. These scammers often reach out to offer loans with low Annual Percentage Rates (APRs) but require upfront fees. To make these fees appear legitimate, they may use terms like processing or application fees.

To create an illusion of authenticity, some scammers even offer to add the upfront fee to your loan amount. They may then simulate a fake electronic transfer to your bank, showing the total amount as transferred.

To protect yourself from falling into such traps, it is crucial to only download apps or software from trusted sources. Verify if the lender is registered in your state and has a valid physical address. If a loan offer seems too good to be true, it most likely is. Genuine lenders do not randomly contact individuals with enticing credit offers.